Grants and Funding Opportunities

Our Process

How We Work?

Discuss your funding needs

Come and discuss your project, innovation, and research and on a no-obligation fee basis we can provide options for grant funding

Engage Us

On engagement, we will help prepare your paperwork and liaise with your company and accountants

Funding Application

On successful receipt of your funding, we will charge a success fee, and help with ongoing compliance.

About the Research & Development Tax Incentive (RDTI)

The Research & Development Tax Incentive (RDTI) is an Australian Government programme that provides tax offsets for expenditure on eligible R&D activities. The aim is to encourage businesses to support the development of new products, processes and services, encourage innovation and increase competitiveness and productivity. It provides cash back, or in some instances a tax saving of up to 43.5% based on your eligible R&D expenditure.

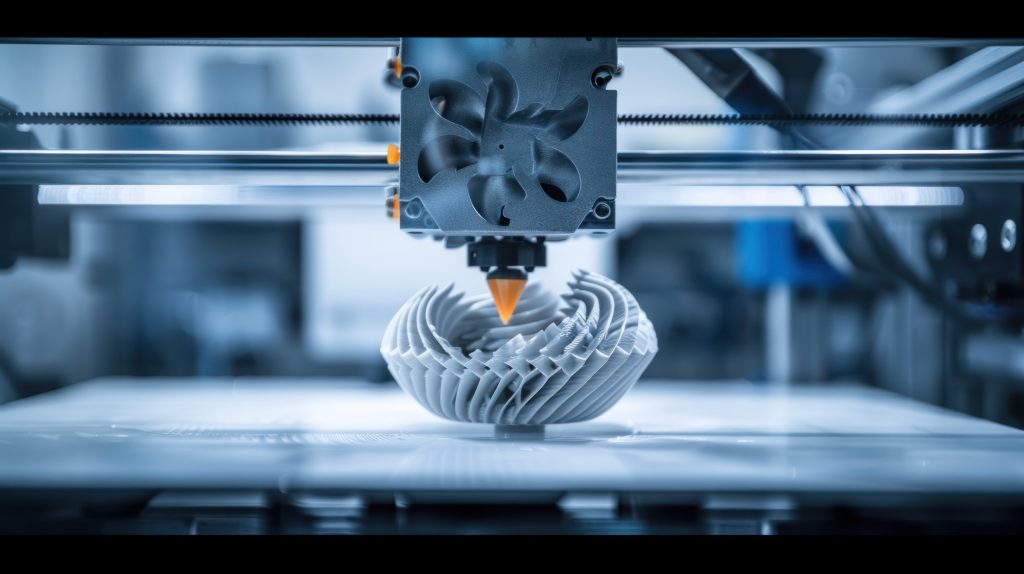

At Global3D, not only can we help with your project, but we can help secure the Research & Development Tax Incentive.

Benefits of the Research & Development Tax Incentive (RDTI)

The Australian Research and Development Tax Incentive (RDTI) is designed to encourage businesses to engage in research and development (R&D) activities. Here are five benefits of the RDTI:

1. Tax Offsets:

The RDTI provides tax offsets for eligible R&D activities. Companies can receive a refundable tax offset if their aggregated turnover is less than $20 million, which can significantly reduce their tax liability or provide a cash refund.

2. Innovation and Growth:

By reducing the financial risk associated with R&D, the RDTI encourages businesses to invest more in innovative projects. This can lead to new products, services, and processes that drive business growth and competitiveness in the market.

3. Increased Cash Flow:

The refundable tax offset can improve cash flow, especially for smaller companies or startups. This additional cash can be reinvested into further R&D activities or other areas of the business.

4. Collaboration and Partnerships:

The incentive can foster collaboration between businesses, universities, and research institutions. This can enhance the quality and scope of R&D projects by leveraging external expertise and resources.

5. Economic Development:

The RDTI supports broader economic development by promoting innovation within the country. Successful R&D projects can lead to job creation, improved productivity, and the development of new industries, contributing to the overall economic growth.

These benefits make the RDTI a valuable tool for companies looking to invest in R&D and contribute to Australia’s innovation landscape.

Contact Us

Contact us to have an obligation free consultation for your grant and funding requirements including the RDTI.